Video Transcribed Below

Introduction:

Hello, good morning and good afternoon. My name is Mark Davis. I am the development manager here at Vigilance Health. And welcome to our webinar. This is the Scott Discover, a powerful FCC UHC strategy. New revenue lines. Thank you all for attending. Just a little bit of health housekeeping. We have all the attendees muted to retain the audio quality and we will provide the presentation material to all the attendees as well as a link to the recording.

And we should have that to you within about 24 hours. Also, we welcome questions and you can type those in to the chat. I’m sorry. The question section of the webinar module. And if we do not get to them during the webinar, we will answer those questions at the end of the webinar. OK. So I will turn it over now to James Coburn, our executive director. Good morning and good afternoon, as markets said. Thank you, Mark.

We have some folks in various time zones with us today. So some of you for some of you as the morning. For some of you in the afternoon. Good morning and good afternoon and welcome to our meeting today where we are going to outline a. A. Well, this will be a discovery for some of you. A discovery around a powerful new APHC strategy, new population health revenue lines. This is going to expand your revenue sources, improve care quality and outcomes, increase margins.

And as the invite said, a way for you to do all of this with no upfront cost, dappy increases or capital investments. And we want to make sure that we we achieve the goal of transmitting this information to you all in a way that can be actionable for some of you. You know us. And you’ve known us over the years to provide a regular regular sets of sessions on regulatory reform, payment reform, meaningful use, timelines, deadlines, trainings.

And it is our mission to always provide timely and actionable information. And if it doesn’t meet that criteria, we don’t include it in our webinars and are at our meetings because we know everybody’s time is critically important. And so, welcome, everyone. We’re excited about providing you with all this information here today. Hopefully everyone can see the screen and can hear. You know, we often times like to get some feedback here real quick just to make sure everybody can see and hear.

So if you could maybe type it into the question section or the chat or whatever. Let us know that you can. Well, if you can’t hear us, then that would be difficult for you to actually follow that instruction. But if you can see. OK. Great. We got some replies. OK. Good. Good. Thank you so much. OK, so. And let’s. Let’s dive in.

The BIG Idea:

OK. So what is the big idea. So.

So listen, we as I had mentioned and as I, as I had actually read from the from the invite, there is a big idea involved. And and really, the idea is so big it deserves reading. And I know you all can read. But our community health centers and community clinics and evaluate these have basically three things that are on your priority list. You know, of course, depending upon your role at the clinic, but expanding revenue sources to diversify, improving care, quality and outcomes.

And increasing margins to ensure financial viability. Obviously, all three of these need to be addressed. But looming policy changes have created a future of uncertainty, and for many, that means increased funding pressures, spending cuts and a reduction in much needed expansion efforts. And even if financial stability is restored, even if it’s restored, even temporarily, as it was just a few days ago, health centers operate on thin margins.

I don’t need to tell you that. Tell you that. So they usually have to tackle those items. Those three items, one at a time. So the big ideas, what if you could advance all three simultaneously with no upfront cost? No staff increases or or or increases in payroll or capital investments? That would clearly be a real advantage to to your to your clinic. And this meeting today is dedicated to explaining how we do that. However, we got to we’ve got to really first kind of know the challenge.

And and some of you are kind of familiar with this information. Some of you have a deep knowledge of this. But let’s first just kind of look at where the challenges. Number one, we’ve got we’ve got ballooning health care costs. And really, these ballooning health care costs are the primary driver for all health care reform and payment reform efforts. And we basically have a health care system that’s about ready to double in size in terms of spending anyway, in the next, just shy of about eight years, a doubling in expenditures is going to pose a significant challenge to our general economy.

And as a part of those expenditures, 93 percent of Medicare spending is on the care of those beneficiaries, beneficiaries with two or more chronic conditions. So clearly, we’ve got to we’ve got to do something about this. And and what’s interesting is we’ve got some results of a of a nationwide study that was done recently. And it’s an extensive survey of about one hundred seventy five evacuated theses to see suite of members nationwide. And and the results are that, well, first of all, we looked at or they the study looked at current challenges and how epicure these are dealing with them.

And what emerged was six broad trends that that that showed itself in the course of analyzing the responses from all these equities. And number one, some of these you may find interesting, some of these you may totally agree with. And and it is and it is your experience. But one of the interesting things is that competition is on the rise. You know, for years, amputees have kind of enjoyed this environment where it really wasn’t, you know, competitive.

You had this patient panel and and you were kind of the only ones that were providing health care services to that to that patient panel. But that’s changing. And financial growth is, of course, a struggle. Profits and margins are down. And that transition from volume to value is slow, which makes it a little bit more challenging to operate into in two worlds. Health center transformation is is, of course, a challenge. And that’s a you know, you all went through one Chout, one transformation with your E.H., our implementation.

And now we’ve got a whole nother challenge or transformation in front of us. Marketing is immature for UHC traditionally, and this was no surprise to us. Marketing efforts are relatively immature and patient retention is a challenge. And we to talk a little bit about that in just a minute. But another kind of interesting thing that came up as a result of this nationwide survey, and that is that actuate these are viewing partnerships as positive and that there are a lot of opportunities for collaboration now as opposed to several years back.

So let’s take a look at a few of these areas. Number one, competition is coming from all sides. This is a fascinating topic. Now we meet we work with a lot of FSU, HD, and we have a lot of strategy meetings with our activities and what we’re hearing from them. We didn’t need this study to tell us this, but what we’re hearing from them is that they are seeing pressures

Coming from various angles. So some of those. Now, the difference between these two these two colored graphs. By the way, the blue are urban Kuwaiti’s, the green is rural. So it’s not surprising that the urban refugees are concerned about other refugees coming into the market. We we we work in certain communities where there’s six six separate RFQ each sees within miles of each other. So so the other of area of competition is urgent care. Of course, also hospitals are you are all experiencing hospitals.

Some hospitals are launching their own RFQ AC. Some have partnered with other amputees. They’re launching their own or purchasing their own primary care clinics. And and also the point of, you know, point of care clinics are becoming a competitive force in the marketplace. And so with it, with with FSU, HD, that are that have marketing that that are experiencing immature marketing strategies, they’re going to find some challenges when competing with some of these with some of these organizations.

And the other thing to remember, although you all RFQ, HD have access to a number of federal, state, you know, grant programs that may that the others may not have access to, some of these organizations have greater economies of scale which enables them to attract providers. Some of you are abroad, probably been in a bidding war for before providers and hiring providers. But the interesting thing is these other entities are specifically eyeing your patients for years.

They didn’t want that panel. Now they’re seeing the value. And so that’s creating some additional additional pressures. So another area. That showed up in this nationwide study is that financial growth struggles. Well, so for example, one area is revenue diversification. Fifty three percent of the CEOs said of these amputees nationwide said that revenue diversification is is a significant challenge for them. And that’s been our experience as well. Virtually all of our refugees that we work with are updating their strategic plans to expand their Part B revenue.

And looking at expanding other patient panels in an effort to diversify their their their revenue sources. And that’s smart. And so, you know, traditionally, the refugees are focused on community events and outreach tactics, you know, poor patient growth and retention. There is there there are there are there are challenges with that now as you have other entrants into the marketplace. So financial sustainability. Fifty fifty six percent of the C suite of these folks that were surveyed are talking about financial sustainability as a primary concern.

But what we found really interesting is that 62 percent of these. CEOs and C Suite have difficulty even measuring their profits. So if profits are the least tracked metric, which came as a result of this of this study and only 62 percent are able to even measure their profits, then we have a significant disconnect. And this with a little bit surprising for us. Not not entirely, because we’ve experienced this and working with some of our clinics, but our recommendation is to really focus in and and get a better handle on your on your profit margin and measuring your profits and measuring your efforts for your for your for your other programs.

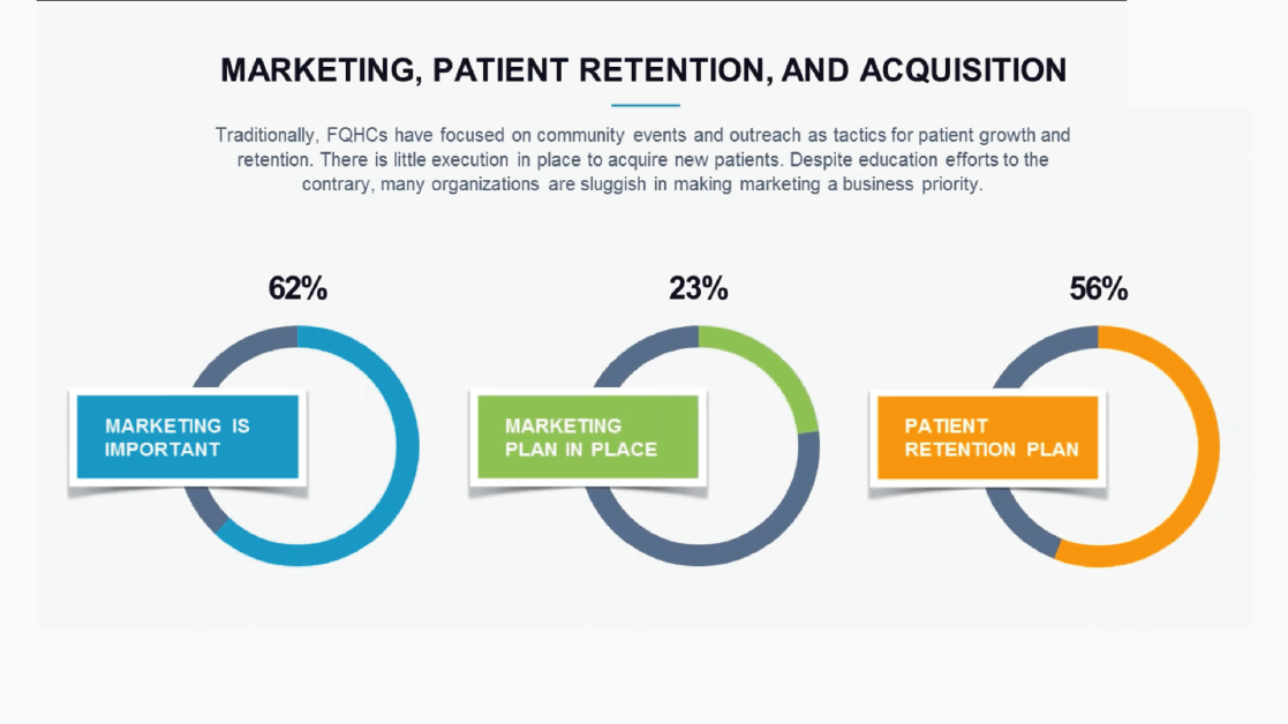

All right. So let’s talk about marketing, patient retention and acquisition. We don’t we already talked about, you know, the marketing challenge and that marketing, you know, is is immature for the APHC marketplace. What we found is that 62 percent of the of the C suite of this group of extubate sees that participated in this study felt that marketing was important, but only 23 percent even had marketing in place. However. Fifty six percent. Of the of the deputies were able to track patient retention, which means that almost half a little less than half of the extubate seas did not even know what their patient retention was.

We can tell you from deep, wide experience in working with community clinics and amputees that that there is a gigantic back door that is open. And the reason we know this is because of the work that we do and we’re finding that a significant chunk of their patients. One of our accuracy’s that we worked with, we found 35 percent of a certain panel, a large panel had not been seen by the clinic in over a year and a half. So now how is that that they wouldn’t notice that?

Well, because they’re patient panel is ballooning in another area. So we believe that probably shutting that back door might be really the best marketing effort that you can make initially. Certainly you want to look at it at other at other marketing efforts similar to what other health care organizations in the community are doing. OK. So another big challenge is we have a slow transition from volume to value and that that presents some challenges. The shift of value based care is really reinventing the way clinics get paid for services.

And as these new reimbursement models become more popular, clinics have to choose carefully because understanding alternative payment models can be the difference between, you know, a thriving business and kind of a sea of red ink or financial losses. And and wouldn’t it be easy if we could just flip the switch on Monday morning in all of our all of our.

Reimbursement contracts are based upon outcomes. Well, I don’t know. Maybe that would be challenging. But if you’re prepared, it would be better than living in two worlds. And if you’re not prepared, that would be could be suicide.

So and not only do we have a slow adoption of alternative payment methods, but it’s also it’s also uneven. So, for example, the results showed that that in 2014. You know, an overwhelming majority of reimbursements were coming from fee for service payments, but you’ll see the trend from 14 to 16 and the projection for four by the end of 18. You’ll see a reduction in standard fee for service payment models. And then when you look over paper performance, we know we saw that we saw a spike in 2016 16.

But but we put the CEOs are projecting a reduction from that spike in 2018. We do see a trend with bundled payments. We do see a trend with with capitation. And I think you all probably are experiencing that.

But nonetheless, we have slow adoption and we have an easy even adoption. So despite the slowness and the unevenness of alternative payment models. I think most people can agree the train has kind of left the station on on the move from Volle from from volume to value or the move to reimburse based upon outcomes. And that really. All roads are really leading to population health management and and that is some might experience a more rapid conversion than others. But the bottom line is, is that really all roads are leaving are leading to population health management.

And so the question really for today’s providers are are not if, but when.

So let’s talk just a little bit about population health management. You’ve heard it a billion times. It is a term in health care that has just beaten to death. But really, it’s it’s not. And it means something different to everyone. If you ask a hundred people with the definition, you’re going to get 99 different different definitions. But the bottom line is we have to define a population. We have to identify the gaps in care. Stratify those risks, engage the patients, keep the patients engaged, manage their care, man.

Measure the outcomes so that we can measure the investment of the work that we’re putting in and then continue to define and redefine our patient populations and identify gaps in care. So, however, a lot of organizations are lacking the data and or the technology and the human capital to support this transition. Because when we get off of this meeting, everybody is going to go back to work and we’re gonna see a waiting room full of patients and everybody’s going to just be trying to get through the day.

Episodic care for patients is not going away and counters will always be there and we will always have to get through the day and see our patients. So how do we move through this transition? Which leads us really to health and our transformation is complex, which was the other?

EMR implementation

The next topic that was really on the minds of all of the leadership of the season and an understanding. And so really, we were piling on the workload for physicians. And, you know, after we had you all had an experience with your EMR implementation and that was it. That was a form of a of a transformation. And it was and it was a painful one, no doubt. I don’t think anybody had it. HRR implementation. That wasn’t painful.

And so it was a transformation effort of sorts. But this one coming Rambert by 10, maybe even 100, because it now we.

Why is a different mindset and a different focus in on activities altering the way providers can provide care while at the same time always singing the mantra of practicing at the top of our license while we pile more work on our providers, which is. No matter what you call it, it is provider torture. And I’m sure you’ve heard the complaints and the concerns from your providers, but they’re getting squeezed at every place. And if you haven’t heard the term torture yet, you’re going to.

We are torturing our providers. If if we could really, truly live up to the promise of providing a mechanism where they could practice at the top of their life license, we will free them up. So the last category of the six categories that emerged as a result of this nationwide study is that the C suite of these RFQ season community clinics overwhelmingly said partnerships are positive and there are more opportunities for for collaboration. A lot of refugees are kind of coming out of their shell and they’re looking at and important relationships, leveraging important relationships and forming alliances so that so that they can realize the promise of population health and provide some some relief to their providers and collaborating with partners who are focused on quality improvement.

It really does allow you to free up providers to practice at the top of their license. And it can create a force multiplier for your providers, which which can provide better access implementation to support services. It increases patient satisfaction scores that patients have better access to healthcare, a personnel improvement in clinical and financial outcomes, and certainly a reduction of provider and staff burden, as we have said. So what’s our strategy? So we all have to look at this kind of from a kind of from a from a from a new angle.

We had a we had a meeting the other day and we talked about I like to use this analogy. Some of you may have had this experience. Certainly some of you may have seen it on a national graph, a National Geographic, if any of you have ever been river rafting. So what you do before you come to a set of rapids is you’ve got to you got to stop the boat. Get out and read the rabbit. Read the rabbit.

And create a strategy for how you’re going to move through this set of rapids in a way where you’re not going to tip the boat over and you’re not going to get sucked into a rapid and die. So so we want to look at this with some kind of perspective and create a strategy around it. The first thing that we want to do is look at the three pillars of Value-Based here and really its organizational alignment, comprehensive care management for those patients with with with chronic conditions, which are most of our patients and reimbursement management, which is which is kind of a new way of looking at the way you generate revenue.

And and so also, I think it’s important to look at the government’s quadrupling, really. It used to be called the triple aim, but now it’s the quadruple. So we’ve left triple aim there because everybody kind of know that it’s triple M. But what the what the feds did. Oh, gosh, about a year and a half ago or so is they they they added one more aim to it and that one more aim is they needed to bring the physicians into the mix or else there was going to be a mass revolt on on payment reform and health care reform.

And so really, the quadruple aim is improving patient care. Providing better patient care, better overall population health, lower health care costs, while improving the provider experience and provider experience, of course, is at an all time low since its ever been measured. Job satisfaction is at its lowest point for providers, and clearly that has a direct impact on patient outcomes. That’s already been been studied for decades. And so we have to look at the quadruple aim even for our own individual organizations.

But in the context of population health. What we’re looking to do is change the patient experience, implement programs for for population health that can that are focused in around health outcomes, disease burdens, behavioral factors, psychological factors. But then we also got to look at the per capita costs. We now need to look at not just the cost of all of our services being provided to that patient in our clinic, but we now need to be accessing data on what that patient’s doing elsewhere because we’re getting graded on that.

And so if we can if we can get better patient engagement, we can actually move the needle on expenditures that they’re that they’re having elsewhere. So these are important areas to look at in terms of reading the rapids. So the other thing that we want to look at are the core domains of any really robust population health management program. And and those core domains are, first of all, care management of high risk patients, disease management to slow the chronic disease progression.

The identification and the closure of gaps in care, which, by the way, when that’s done, that has an immediate impact on on quality measures. The others have a little bit of a slower impact. And then we all we also have to look at reducing cost, reducing, reducing non-critical E.R. visits and and hospital readmit.

So we. We recommend a a new population health management strategy for RFQ, HD and community clinics. This is a discovery that came to us slowly but loudly. And as we over the years, as we’ve been working with all of our after issues and community clinics, we have found and have developed, part of it was a discovery. And part of it was it was a development is a new strategy for it for F2, HD that can enable them to roll.

Population health management programs out well, that have a a significant new and immediate revenue impact. Well, helping the organization move into population health management services for the rest of those patient populations. It really is the best of all worlds when you look at what a might. What are we going to do to move into these new payment models? Well, if we if we if we have a way where we can implement new services, get paid for those new services immediately, we can now fund the transition and those services, our general care management.

The feds are CNS has been slowly but surely adding new codes, raising reimbursements around general and chronic care management. They have been incentivizing organizations over the last few years to really dive deeper into the annual wellness visit, which really is a which is an in-depth health risk assessment to identify gaps in care so that they can be filled. Remote patient monitoring is it is a brand new area for RFQ HD, which we’re going to talk about in just a minute.

And then, of course, behavioral health integration and also these new prevention programs, diabetes prevention programs some of you have have already launched into. And for those of you that haven’t. We really recommend you taking a look at that. So let’s let’s take a look. So so, first of all, chronic care management, which is now called general care management. This is the name Medicare gave to it, to a new reimbursable service that involves care coordination and care management.

And really, when you look at payment reform and health care delivery reform, care coordination and care management is really at the heart of it all. And and really, it’s a way of rewarding and incentivizing folks to move into managed care. Really, it’s really the Kaiser model. And so and it is a it is a very powerful population health management tool. And and it has a significant impact on patient satisfaction scores and and outcomes scores. So why would we want to do this?

Well, for those reasons that I just mentioned, but also it’s good medicine. We eat by now having another resource, a new resource that can work with those patients in between their normal follow ups with their provider, allowing their provider to practice at the top of their license while utilizing a care manager or a care coordinator to keep the patient on track with their directives. It’s just flat out good medicine, because what we what we yield is a more compliant patient and a more compliant patient.

It has better outcomes. It’s also a good clinic business model. Medicare open this up for amputees and significantly raise the reimbursement rate for amputees as a further incentive to do this. And it’s a good Medicare business model because they’ve already seen a significant reduction in non-critical E.R. visits and hospital readmit. So clearly, a lot of money is being saved. And we’re we are probably going to see this reimbursement continue to edge up. We just saw. I think, Mark, what was it, a 40, 38 percent increase, about a month and a half to close to double.